Global Smart Cutting Tool Cabinet Market Analysis Report

In the context of the manufacturing industry accelerating its transformation towards intelligence and refinement, smart cutting-tool cabinets, as key equipment for optimizing tool management and enhancing production efficiency, are experiencing profound changes and vigorous development in the market. This report focuses on the global smart cutting-tool cabinet market, deeply analyzing the industry status, competitive landscape, driving factors, and future trends, aiming to provide high-value decision-making basis for practitioners, investors, and relevant parties.

- The Market Size of Global Smart Cutting-Tool Cabinet

1.1 Policy Analysis of Global Smart Cutting-Tool Cabinet Industry

1.2. New Increment Market Size and Trends of Global Smart Cutting-Tool Cabinets

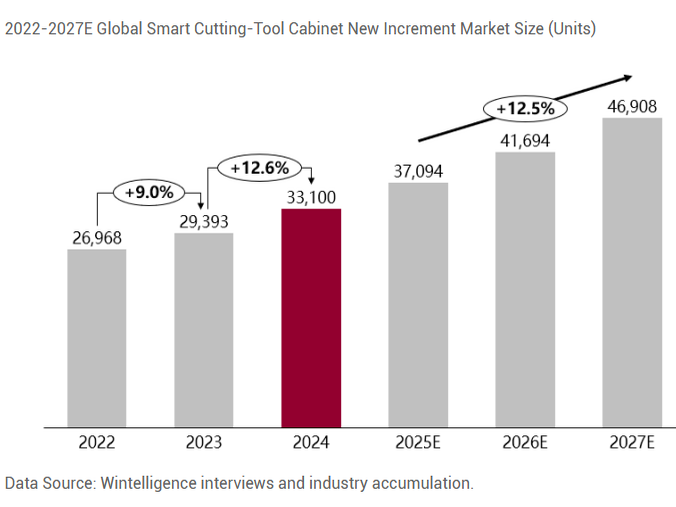

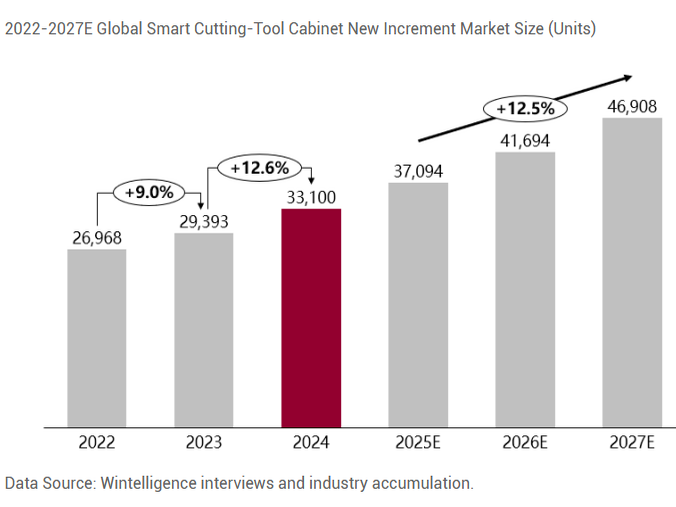

Figure 2: 2022-2027E Global Smart Cutting-Tool Cabinet New Increment Market Size (Units)

Data Source: Wintelligence interviews and industry accumulation.

In 2024, the global smart cutting-tool cabinet market size showed a rapid growth trend, mainly driven by the automation upgrade of the manufacturing industry. It is expected that the compound annual growth rate (CAGR) from 2025 to 2027 will remain at about 12%. The Asian market (especially China) occupies a dominant position, contributing more than 40% of the global market share, mainly benefiting from the smart manufacturing needs of industries such as automobiles and 3C electronics.

Regionally, the Asian market takes China as the core growth region. The market size of smart tool cabinets in China has entered a stage of rapid growth, mainly due to the popularization of Industry 4.0 and smart manufacturing, which requires digital and traceable tool management. Moreover, with the domestic substitution and technological development, the penetration rate of CNC tools has increased, promoting the application of smart tool cabinets in the field of precision manufacturing and further accelerating the penetration of smart cutting-tool cabinets. In the future, driven by the continuous technological breakthroughs of local manufacturers, policy support, and industry demand, it is expected to maintain a growth rate of more than 15% from 2025 to 2027.

The European and American markets, as the core regions of traditional manufacturing and technological innovation, drive market growth with high-end manufacturing demand and technological leadership respectively. The North American region mainly benefits from the demand for high-precision and automated tool management systems in the automotive manufacturing, aerospace, and semiconductor industries, and is expected to maintain a growth rate of about 5-8% in the future. In the European region, driven by the Industry 4.0 policy, the penetration rate of smart tool cabinets in machinery manufacturing has significantly increased, especially the strong supporting demand for high-end machine tools in Germany. Moreover, the EU's green manufacturing regulations promote the development of smart cutting-tool cabinets towards energy conservation and environmental protection. For example, Hoffmann SE has launched cutting-tool cabinets made of low-carbon steel and reduced energy consumption through solar power supply solutions to meet ESG requirements. It is expected that the market share of such equipment will grow rapidly in the future.

The Japanese and Korean markets, as the core regions of global high-end manufacturing, drive the demand for high-precision smart tool cabinets in Japan with precision machinery, automotive manufacturing, and semiconductor industries. South Korea has a significant demand for intelligent and automated management tools due to the rapid development of the electronics manufacturing and robotics industries, and is expected to maintain a growth rate of about 8-10% in the future.

The Southeast Asian region benefits from the transfer of manufacturing industries. Countries such as Vietnam, Thailand, and Malaysia have rapid growth in electronics and auto parts production, and the demand for smart tool cabinets is expected to grow rapidly, reaching a growth rate of about 10-12%. However, from the perspective of product demand, the demand for mid-to-low-end tool cabinets is dominant. But with industrial upgrading, the penetration rate of smart cutting-tool cabinets in electronics foundries will gradually increase.

1.3. Global Smart Cutting-Tool Cabinet Manufacturer Landscape

Figure 3: 2024 Global Smart Tool Cabinet Manufacturer Landscape (Units)

The global smart cutting-tool cabinet industry has a low market concentration. In 2024, the market share of the top 10 manufacturers was only about 45%, and the share of the top 15 manufacturers was less than 60%. This is mainly because the technical barriers of smart tool cabinets are low, and more and more entrants have made the competition fierce.

From the perspective of segmented manufacturers, European and American manufacturers dominate the high-end market. The smart cutting-tool cabinets they design have a high degree of integration with CNC machine tools and have a high market share in high-end fields such as aerospace and medical care. Among them, Crib Master and Hoffmann SE have the highest market share in the global high-end market by virtue of stable performance and precise tool management. In recent years, Chinese smart tool cabinet manufacturers have rapidly risen, quickly occupied the mid-to-low-end market, and gradually moved overseas, with their market share growing rapidly. Among them, SmartBee has reached the top global market share with high cost performance.

2. Analysis of Growth Potential and Trends of Global Smart Cutting-Tool Cabinets

2.1 Technical Development Trends of Global Smart Cutting-Tool Cabinets

From the perspective of product technical development trends, future smart tool cabinets will develop towards intelligence, customization, and energy conservation and environmental protection.

Intelligence is the key trend in the technical development of future smart tool cabinets. Smart tool cabinets can achieve precise identification, positioning, and tracking of tools by integrating RFID, sensors, and AI algorithms, and synchronize data with MES/ERP systems in real time to optimize inventory management and production scheduling. Based on big data analysis, smart tool cabinets can real-time monitor the wear status of tools, issue early warnings for replacement needs, and reduce downtime.

Customization can design tool cabinets that meet the production process, space layout, and management requirements of customers according to their specific needs. For example, automobile manufacturing enterprises have large production scales, frequent tool use, and a variety of tool types, and may need large-capacity and highly automated tool cabinets that can be closely integrated with production lines. Small mechanical processing enterprises may pay more attention to the economy and practicality of tool cabinets and require basic tool management functions. Customization can also be optimized for special environments. For example, tool cabinets used in dusty environments can increase dust-proof sealing design to protect tools and internal electronic components.

In response to the global carbon neutrality requirements, various enterprises have improved their global competitiveness through green certifications. In the future, the operation mode can be dynamically adjusted through IoT sensors and big data analysis to reduce invalid energy consumption. Energy-saving technologies such as LED lighting and intelligent induction switches can be integrated. Some manufacturers have adopted solar power supply or energy storage systems. Environmental protection can also be achieved through raw material innovation, such as using recyclable metals or bio-based composite materials to reduce pollution. In addition, some manufacturers have launched tool recycling and refurbishment services to extend the product life cycle.

2.2 Analysis of Growth Potential and Trends of Global Smart Cutting-Tool Cabinets

The global smart tool cabinet market is expected to have a CAGR of about 12% from 2025 to 2027, mainly driven by the automation upgrade of the manufacturing industry, the advancement of Industry 4.0, and the demand from emerging markets. Among them, the European, American, Japanese, and Korean markets are dominated by high-end manufacturing demand, and highly intelligent, integrated, and environmentally friendly products are expected to maintain steady growth.

In the Chinese market, with the transformation and upgrading of the manufacturing industry towards intelligence and automation, enterprises have become more strict in the management of the production process. As a key equipment to realize intelligent tool management, smart tool cabinets can improve production efficiency, reduce costs, and ensure product quality. Moreover, with the continuous increase of national policies, the demand for smart tool cabinets is rapidly growing. At present, the coverage rate of smart tool cabinets in small and medium-sized enterprises is relatively low due to cost limitations. In the future, with the support of national tax incentives and other subsidy policies, as well as the continuous technological progress of smart tool cabinet manufacturers, product optimization, and the increase of market participants, the price of smart tool cabinets will be further reduced, which will stimulate the growing demand for smart tool cabinets from small and medium-sized enterprises.

Driven by multiple factors such as industrial upgrading, policy dividends, and technological penetration, Southeast Asia shows strong growth potential. Smart tool cabinet manufacturers can focus on the Southeast Asian region, focus on the rapidly expanding fields such as automotive electronics and semiconductor manufacturing, provide customized solutions, develop scalable smart tool cabinets, support subsequent function upgrades, and adapt to the phased digital transformation needs of enterprises.

3. Introduction to Typical Manufacturers

3.1. SmartBee

Company Name: Shenzhen Danfoo Technology Co., Ltd.

Country: China

Establishment Time: 2015

Company Profile: Shenzhen Danfoo Technology Co., Ltd. was founded in 2015. It is a technology-based enterprise focusing on digital solutions for the machining industry. Headquartered in Shenzhen, it has a subsidiary in Suzhou and offices in Ningbo, Qingdao, Xiamen, Xi'an, Zhengzhou, Weihai, Tianjin, Jinan, and Sichuan-Chongqing. The company currently has more than 100 employees, with R&D personnel accounting for 50%. In 2017, it obtained angel round financing from Tsinghua capital. In 2019, it launched the R&D of industrial Internet products and put them into the market. In 2021, it officially commercialized smart tool cabinet products. At present, it has served more than 6,000 machining enterprises, including more than 200 listed companies and industry leaders, and has expanded to more than 30 countries and regions around the world.

Main Business: Smart tool cabinets, SmartBee machining cloud system, SmartBee MES.

Smart Cutting-Tool Cabinet Products:

- SmartBeeBox S: Supports facial recognition and code scanning for tool retrieval, automatically records tool borrowing and returning information, with 60 spirals that can accommodate 1,200 tools, suitable for the needs of small and medium-sized workshops.

- SmartBeeBox X: Facing high-end management scenarios, integrating AI algorithms to optimize access paths, supporting complex tool classification management, and having both scientific and technological design and high stability.

- SmartBeeBox PRO: Supports multiple functions, including tool borrowing, tool returning, temporary storage, and warehouse changing, etc., and can change the set functions according to needs, with high flexibility.

- Cute Bee: Specifically designed for small workshops, with simple functions and moderate capacity, supporting core management needs such as tool borrow records and return tracking.

- Intelligent Weighing Cabinet TW Series: Aiming at the management of high-value and key consumables, it adopts 0.1g high-precision weighing technology to real-time monitor inventory changes and trigger warnings, suitable for unmanned management and control of automated production lines.

3.2. CribMaster

Company Name: CribMaster Inc.

Country: United States

Establishment Time: 1992

Company Profile: CribMaster is a global leading provider of smart warehousing and automated tool management solutions. Headquartered in the United States, it is a subsidiary of Stanley Black & Decker. The company focuses on optimizing the management efficiency of tools, cutting tools, and consumables in the industrial field through technological innovation, helping customers achieve precise inventory control and automated production process upgrades. At present, it has provided services to more than 12,000 customers in 36 countries/regions.

Main Business: Intelligent tool and consumable management, industrial vending solutions, software-driven inventory management platforms, and industry customized services.

Smart Tool Cabinet Products:

- VendingMate Series Tool Cabinets: Modular smart cabinets that support flexible expansion and customized configuration, such as multi-cabinet linkage and permission hierarchical management, suitable for the needs of workshops of different scales.

3.3. Hoffmann SE

Company Name: Hoffmann Group

Country: Germany

Establishment Time: 1919

Company Profile: Hoffmann SE was founded in 1919. In the early days of its establishment, it mainly sold welding equipment and auto parts, and then gradually expanded to the industrial tool field. In 1993, the Hoffmann Group was officially established, integrating multiple partners and becoming a leader in the German market. In 2003, the company established the English name "Hoffmann Group" and covered more than 50 countries including China, Southeast Asia, Europe, etc. through global branches and partner networks. The company takes the high-end tool brands GARANT and HOLEX as the core, providing products such as cutting tools, fixtures, and measuring tools, which are widely used in fields such as automobile manufacturing and aerospace. In 2022, the Swiss SFS Group merged Hoffmann SE to further strengthen its international competitiveness and expand product lines and service scopes.

Main Business: Tool supply chain management, smart warehousing solutions, one-stop procurement of industrial consumables.

Smart Tool Cabinet Products:

- PROFIX Smart Tool Cabinet: Supports RFID management and integrates the Hoffmann tool database.

All the above data is sourced from Wintelligence Consulting. This article is only a translation.

This article has merely been translated, aiming to provide information for reference to the machining industry.

All the above data is sourced from Wintelligence Consulting. This article is only a translation.

This article has merely been translated, aiming to provide information for reference to the machining industry.

In the context of the manufacturing industry accelerating its transformation towards intelligence and refinement, smart cutting-tool cabinets, as key equipment for optimizing tool management and enhancing production efficiency, are experiencing profound changes and vigorous development in the market. This report focuses on the global smart cutting-tool cabinet market, deeply analyzing the industry status, competitive landscape, driving factors, and future trends, aiming to provide high-value decision-making basis for practitioners, investors, and relevant parties.

- The Market Size of Global Smart Cutting-Tool Cabinet

1.1 Policy Analysis of Global Smart Cutting-Tool Cabinet Industry

1.2. New Increment Market Size and Trends of Global Smart Cutting-Tool Cabinets

Figure 2: 2022-2027E Global Smart Cutting-Tool Cabinet New Increment Market Size (Units)

Data Source: Wintelligence interviews and industry accumulation.

In 2024, the global smart cutting-tool cabinet market size showed a rapid growth trend, mainly driven by the automation upgrade of the manufacturing industry. It is expected that the compound annual growth rate (CAGR) from 2025 to 2027 will remain at about 12%. The Asian market (especially China) occupies a dominant position, contributing more than 40% of the global market share, mainly benefiting from the smart manufacturing needs of industries such as automobiles and 3C electronics.

Regionally, the Asian market takes China as the core growth region. The market size of smart tool cabinets in China has entered a stage of rapid growth, mainly due to the popularization of Industry 4.0 and smart manufacturing, which requires digital and traceable tool management. Moreover, with the domestic substitution and technological development, the penetration rate of CNC tools has increased, promoting the application of smart tool cabinets in the field of precision manufacturing and further accelerating the penetration of smart cutting-tool cabinets. In the future, driven by the continuous technological breakthroughs of local manufacturers, policy support, and industry demand, it is expected to maintain a growth rate of more than 15% from 2025 to 2027.

The European and American markets, as the core regions of traditional manufacturing and technological innovation, drive market growth with high-end manufacturing demand and technological leadership respectively. The North American region mainly benefits from the demand for high-precision and automated tool management systems in the automotive manufacturing, aerospace, and semiconductor industries, and is expected to maintain a growth rate of about 5-8% in the future. In the European region, driven by the Industry 4.0 policy, the penetration rate of smart tool cabinets in machinery manufacturing has significantly increased, especially the strong supporting demand for high-end machine tools in Germany. Moreover, the EU's green manufacturing regulations promote the development of smart cutting-tool cabinets towards energy conservation and environmental protection. For example, Hoffmann SE has launched cutting-tool cabinets made of low-carbon steel and reduced energy consumption through solar power supply solutions to meet ESG requirements. It is expected that the market share of such equipment will grow rapidly in the future.

The Japanese and Korean markets, as the core regions of global high-end manufacturing, drive the demand for high-precision smart tool cabinets in Japan with precision machinery, automotive manufacturing, and semiconductor industries. South Korea has a significant demand for intelligent and automated management tools due to the rapid development of the electronics manufacturing and robotics industries, and is expected to maintain a growth rate of about 8-10% in the future.

The Southeast Asian region benefits from the transfer of manufacturing industries. Countries such as Vietnam, Thailand, and Malaysia have rapid growth in electronics and auto parts production, and the demand for smart tool cabinets is expected to grow rapidly, reaching a growth rate of about 10-12%. However, from the perspective of product demand, the demand for mid-to-low-end tool cabinets is dominant. But with industrial upgrading, the penetration rate of smart cutting-tool cabinets in electronics foundries will gradually increase.

1.3. Global Smart Cutting-Tool Cabinet Manufacturer Landscape

Figure 3: 2024 Global Smart Tool Cabinet Manufacturer Landscape (Units)

The global smart cutting-tool cabinet industry has a low market concentration. In 2024, the market share of the top 10 manufacturers was only about 45%, and the share of the top 15 manufacturers was less than 60%. This is mainly because the technical barriers of smart tool cabinets are low, and more and more entrants have made the competition fierce.

From the perspective of segmented manufacturers, European and American manufacturers dominate the high-end market. The smart cutting-tool cabinets they design have a high degree of integration with CNC machine tools and have a high market share in high-end fields such as aerospace and medical care. Among them, Crib Master and Hoffmann SE have the highest market share in the global high-end market by virtue of stable performance and precise tool management. In recent years, Chinese smart tool cabinet manufacturers have rapidly risen, quickly occupied the mid-to-low-end market, and gradually moved overseas, with their market share growing rapidly. Among them, SmartBee has reached the top global market share with high cost performance.

2. Analysis of Growth Potential and Trends of Global Smart Cutting-Tool Cabinets

2.1 Technical Development Trends of Global Smart Cutting-Tool Cabinets

From the perspective of product technical development trends, future smart tool cabinets will develop towards intelligence, customization, and energy conservation and environmental protection.

Intelligence is the key trend in the technical development of future smart tool cabinets. Smart tool cabinets can achieve precise identification, positioning, and tracking of tools by integrating RFID, sensors, and AI algorithms, and synchronize data with MES/ERP systems in real time to optimize inventory management and production scheduling. Based on big data analysis, smart tool cabinets can real-time monitor the wear status of tools, issue early warnings for replacement needs, and reduce downtime.

Customization can design tool cabinets that meet the production process, space layout, and management requirements of customers according to their specific needs. For example, automobile manufacturing enterprises have large production scales, frequent tool use, and a variety of tool types, and may need large-capacity and highly automated tool cabinets that can be closely integrated with production lines. Small mechanical processing enterprises may pay more attention to the economy and practicality of tool cabinets and require basic tool management functions. Customization can also be optimized for special environments. For example, tool cabinets used in dusty environments can increase dust-proof sealing design to protect tools and internal electronic components.

In response to the global carbon neutrality requirements, various enterprises have improved their global competitiveness through green certifications. In the future, the operation mode can be dynamically adjusted through IoT sensors and big data analysis to reduce invalid energy consumption. Energy-saving technologies such as LED lighting and intelligent induction switches can be integrated. Some manufacturers have adopted solar power supply or energy storage systems. Environmental protection can also be achieved through raw material innovation, such as using recyclable metals or bio-based composite materials to reduce pollution. In addition, some manufacturers have launched tool recycling and refurbishment services to extend the product life cycle.

2.2 Analysis of Growth Potential and Trends of Global Smart Cutting-Tool Cabinets

The global smart tool cabinet market is expected to have a CAGR of about 12% from 2025 to 2027, mainly driven by the automation upgrade of the manufacturing industry, the advancement of Industry 4.0, and the demand from emerging markets. Among them, the European, American, Japanese, and Korean markets are dominated by high-end manufacturing demand, and highly intelligent, integrated, and environmentally friendly products are expected to maintain steady growth.

In the Chinese market, with the transformation and upgrading of the manufacturing industry towards intelligence and automation, enterprises have become more strict in the management of the production process. As a key equipment to realize intelligent tool management, smart tool cabinets can improve production efficiency, reduce costs, and ensure product quality. Moreover, with the continuous increase of national policies, the demand for smart tool cabinets is rapidly growing. At present, the coverage rate of smart tool cabinets in small and medium-sized enterprises is relatively low due to cost limitations. In the future, with the support of national tax incentives and other subsidy policies, as well as the continuous technological progress of smart tool cabinet manufacturers, product optimization, and the increase of market participants, the price of smart tool cabinets will be further reduced, which will stimulate the growing demand for smart tool cabinets from small and medium-sized enterprises.

Driven by multiple factors such as industrial upgrading, policy dividends, and technological penetration, Southeast Asia shows strong growth potential. Smart tool cabinet manufacturers can focus on the Southeast Asian region, focus on the rapidly expanding fields such as automotive electronics and semiconductor manufacturing, provide customized solutions, develop scalable smart tool cabinets, support subsequent function upgrades, and adapt to the phased digital transformation needs of enterprises.

3. Introduction to Typical Manufacturers

3.1. SmartBee

Company Name: Shenzhen Danfoo Technology Co., Ltd.

Country: China

Establishment Time: 2015

Company Profile: Shenzhen Danfoo Technology Co., Ltd. was founded in 2015. It is a technology-based enterprise focusing on digital solutions for the machining industry. Headquartered in Shenzhen, it has a subsidiary in Suzhou and offices in Ningbo, Qingdao, Xiamen, Xi'an, Zhengzhou, Weihai, Tianjin, Jinan, and Sichuan-Chongqing. The company currently has more than 100 employees, with R&D personnel accounting for 50%. In 2017, it obtained angel round financing from Tsinghua capital. In 2019, it launched the R&D of industrial Internet products and put them into the market. In 2021, it officially commercialized smart tool cabinet products. At present, it has served more than 6,000 machining enterprises, including more than 200 listed companies and industry leaders, and has expanded to more than 30 countries and regions around the world.

Main Business: Smart tool cabinets, SmartBee machining cloud system, SmartBee MES.

Smart Cutting-Tool Cabinet Products:

- SmartBeeBox S: Supports facial recognition and code scanning for tool retrieval, automatically records tool borrowing and returning information, with 60 spirals that can accommodate 1,200 tools, suitable for the needs of small and medium-sized workshops.

- SmartBeeBox X: Facing high-end management scenarios, integrating AI algorithms to optimize access paths, supporting complex tool classification management, and having both scientific and technological design and high stability.

- SmartBeeBox PRO: Supports multiple functions, including tool borrowing, tool returning, temporary storage, and warehouse changing, etc., and can change the set functions according to needs, with high flexibility.

- Cute Bee: Specifically designed for small workshops, with simple functions and moderate capacity, supporting core management needs such as tool borrow records and return tracking.

- Intelligent Weighing Cabinet TW Series: Aiming at the management of high-value and key consumables, it adopts 0.1g high-precision weighing technology to real-time monitor inventory changes and trigger warnings, suitable for unmanned management and control of automated production lines.

3.2. CribMaster

Company Name: CribMaster Inc.

Country: United States

Establishment Time: 1992

Company Profile: CribMaster is a global leading provider of smart warehousing and automated tool management solutions. Headquartered in the United States, it is a subsidiary of Stanley Black & Decker. The company focuses on optimizing the management efficiency of tools, cutting tools, and consumables in the industrial field through technological innovation, helping customers achieve precise inventory control and automated production process upgrades. At present, it has provided services to more than 12,000 customers in 36 countries/regions.

Main Business: Intelligent tool and consumable management, industrial vending solutions, software-driven inventory management platforms, and industry customized services.

Smart Tool Cabinet Products:

- VendingMate Series Tool Cabinets: Modular smart cabinets that support flexible expansion and customized configuration, such as multi-cabinet linkage and permission hierarchical management, suitable for the needs of workshops of different scales.

3.3. Hoffmann SE

Company Name: Hoffmann Group

Country: Germany

Establishment Time: 1919

Company Profile: Hoffmann SE was founded in 1919. In the early days of its establishment, it mainly sold welding equipment and auto parts, and then gradually expanded to the industrial tool field. In 1993, the Hoffmann Group was officially established, integrating multiple partners and becoming a leader in the German market. In 2003, the company established the English name "Hoffmann Group" and covered more than 50 countries including China, Southeast Asia, Europe, etc. through global branches and partner networks. The company takes the high-end tool brands GARANT and HOLEX as the core, providing products such as cutting tools, fixtures, and measuring tools, which are widely used in fields such as automobile manufacturing and aerospace. In 2022, the Swiss SFS Group merged Hoffmann SE to further strengthen its international competitiveness and expand product lines and service scopes.

Main Business: Tool supply chain management, smart warehousing solutions, one-stop procurement of industrial consumables.

Smart Tool Cabinet Products:

- PROFIX Smart Tool Cabinet: Supports RFID management and integrates the Hoffmann tool database.

All the above data is sourced from Wintelligence Consulting. This article is only a translation.

This article has merely been translated, aiming to provide information for reference to the machining industry.

All the above data is sourced from Wintelligence Consulting. This article is only a translation.

This article has merely been translated, aiming to provide information for reference to the machining industry.